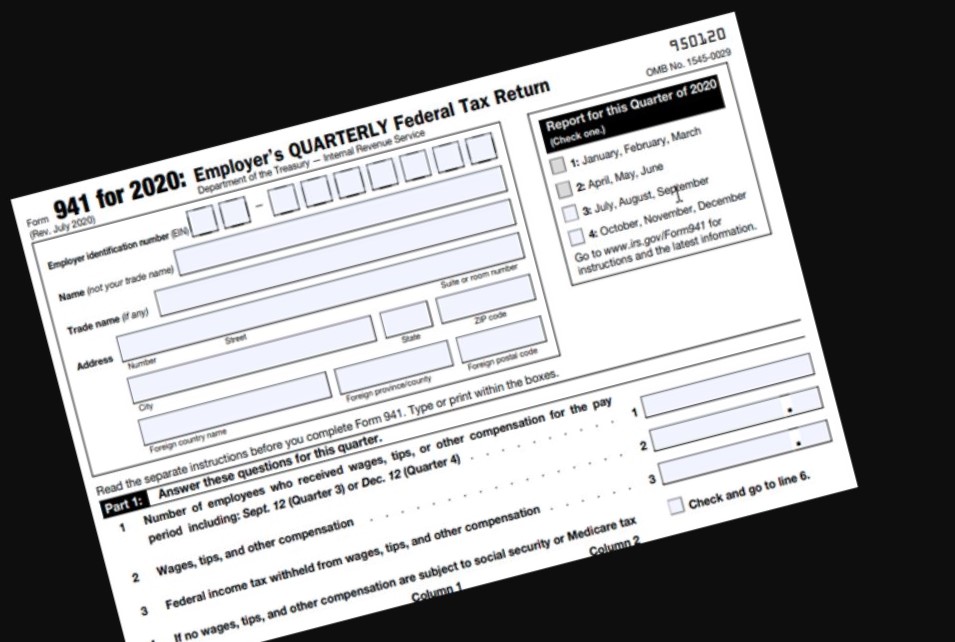

Be prepared for IRS audits of COVID-19 ERC claims

ERC in a nutshell The ERC is a refundable [...]

Corporate Transparency Act and Beneficial Ownership Information Reporting

The Corporate Transparency Act (“CTA”) was enacted by Congress [...]

Year End Tax Planning Reminders

Medical Insurance for Shareholders (S corporations only) An S [...]

2022 S Corporation Year End Tax Planning and Reminders

As an S Corporation, the below year-end housekeeping items [...]

Pass-Through Entity (PTE) – Elective Tax

In July 2021, Oregon established an elective Pass-Through Entity Tax [...]

New Multnomah County Preschool For All Personal Income Tax

In November 2020, the voters of Multnomah County approved a [...]

New Metro Support Housing Services

In May 2020, the voters in the greater Portland area [...]

Oregon Pass-Through Entities (PTE) Reduced Tax Rate

Oregon has had a special reduced tax rate (generally up [...]

Taxation of Cryptocurrency and Compliance

Ever since bitcoin entered the financial stage in 2009, [...]

New and Improved Employee Retention Credit

Whether you were already taking advantage of the Employee Retention [...]

Key Tax Takeaways from COVID-19 Relief Bill

On December 27, 2020, the President signed the Consolidated Appropriations [...]

Information Returns: Federal and Oregon Filing Requirements

The due date for 2020 Forms W-2, W-3, 1099-MISC, and [...]