Are your operating reserves enough?

Operating reserves - generally, assets without donor restrictions that [...]

Using technology to meet your nonprofit’s goals

In today’s technologically advanced world, data rules. But simply [...]

What’s the magic number? Some guidelines for determining your board’s size

Small boards Smaller boards allow for easier communication and [...]

Understanding internal controls

The median loss for nonprofits that fell victim to [...]

What nonprofits need to know about alternative investments

With today’s economic uncertainty, businesses, including nonprofit organizations, are [...]

Nonprofits: Do your due diligence before taking out a loan

Most Americans take out loans at some point in [...]

Crowdfunding comes with tax risks

Crowdfunding campaigns are designed to raise money for individuals [...]

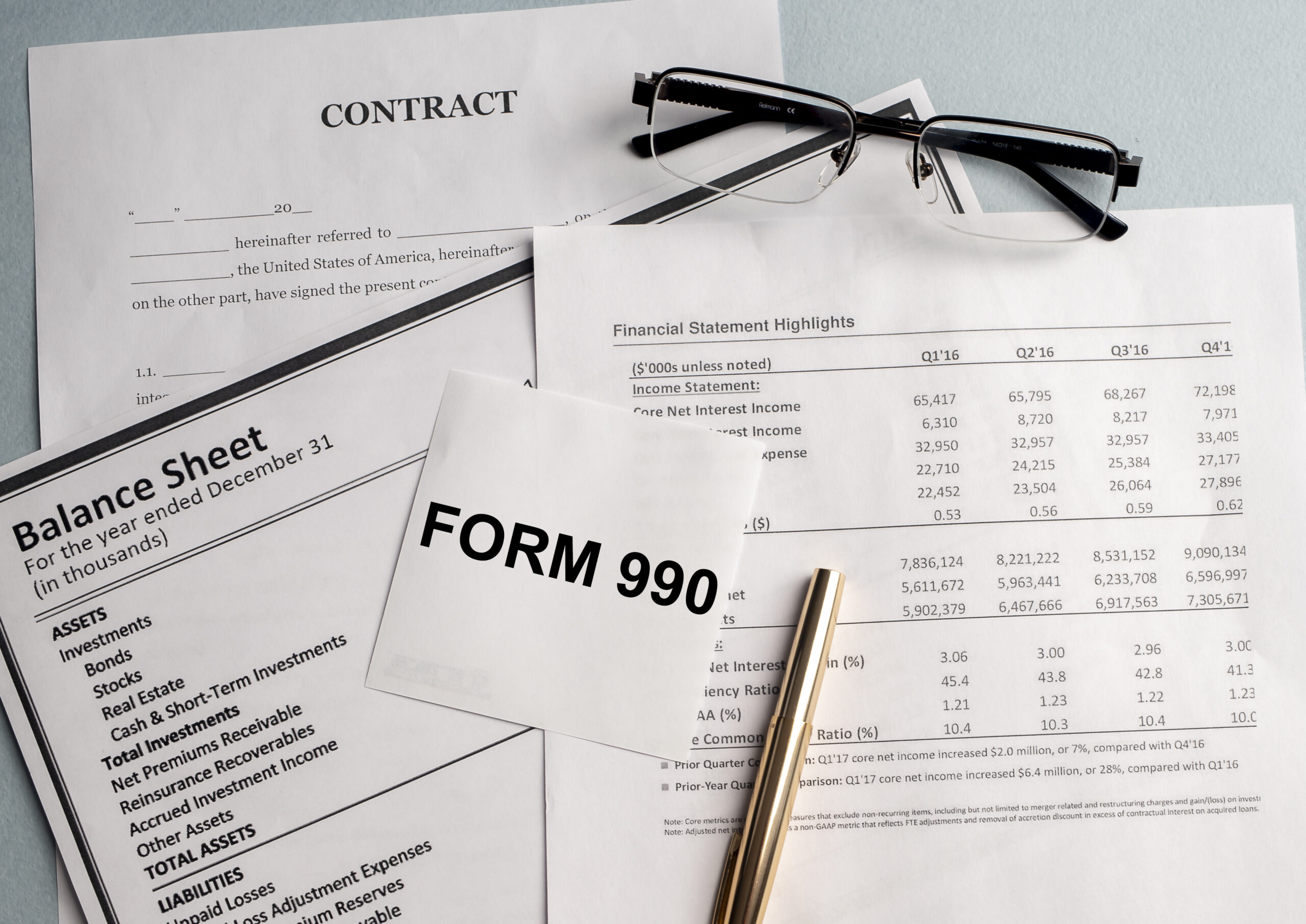

What do you know about Form 990? Board review can benefit nonprofit governance.

Most board members know- or should know- that the [...]

Be prepared for IRS audits of COVID-19 ERC claims

ERC in a nutshell The ERC is a refundable [...]

How an energy-efficient building tax deduction could pay off for nonprofits

Tax break becomes permanent IRS Section 179D deduction for [...]

New Current Expected Credit Loss (CECL) accounting rule could bring change to nonprofits’ financial statements

A new accounting standard from the Financial Accounting Standards [...]

7 Tasks For Successful Nonprofit Finance Committee

7 tasks for a successful nonprofit finance committee A [...]